Spotlight: Helping clients navigate turbulent markets

Spotlight: Helping clients navigate turbulent markets

Investing in a ‘news-rich’ environment

Rules-based investment management, a holistic portfolio approach, and a focus on controllable factors can help advisors guide clients through market noise. Read more

Why advisors continue to favor risk-managed strategies

Financial advisors continue to turn to risk-managed strategies that seek less-volatile growth through full market cycles. Read more

‘Believable’ misinformation is a danger to long-term retirement goals

Many investment “truths” are clearly myths. Advisors and their clients should not accept information seen as common knowledge if it is not entirely accurate. Read more

INDUSTRY INSIGHTS

In-depth examinations of significant developments in investment research, financial technology, behavioral finance, and active management approaches.

ADVISOR PERSPECTIVES

Experienced financial advisors discuss practice philosophy, client service, investment strategies, and how they have set their practices apart.

MARKET COMMENTARY

Observations and outlooks from well-known technical and research analysts, financial authors, and economists.

PRACTICE MANAGEMENT

Successful financial advisors provide tips on business-building strategies, including prospecting, obtaining referrals, client communications, marketing, technology, and more.

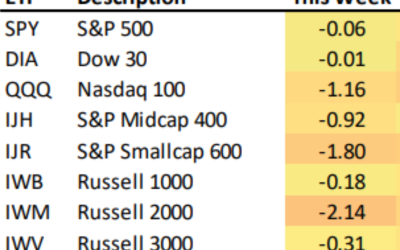

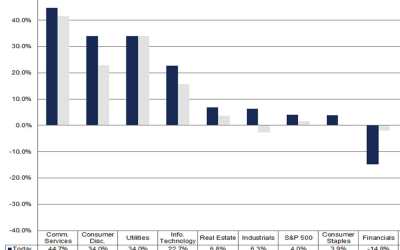

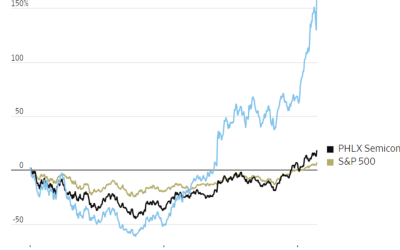

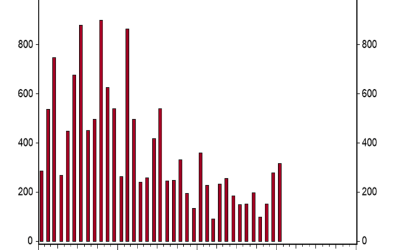

WEEKLY CHART REVIEW

Analysis of a timely market or economic theme illustrated with insightful charts.

Subscribe for new articles each week

No charge. Dedicated to promoting and educating the advisor community on active investment management through original, leading-edge content.

QUICK TIP

The benefits of working with third-party investment managers

Diana Avery is the founder of Avery Financial Services, located in Atlanta, Georgia, and is an investment advisor representative of LPL Financial. She says that using managed accounts and the services of third-party investment managers “provides several benefits” for her firm and clients, including the following:

- Sophisticated, rules-based investment strategies.

- Strategies and options for portfolio allocations that can emphasize strong diversification and risk management.

- The ability to take advantage of tactical or active portfolio strategies.

- The ability to modify a client’s portfolio allocations if objectives or life circumstances change.

- A variety of portfolio options that are appropriate for clients across many different risk profiles.